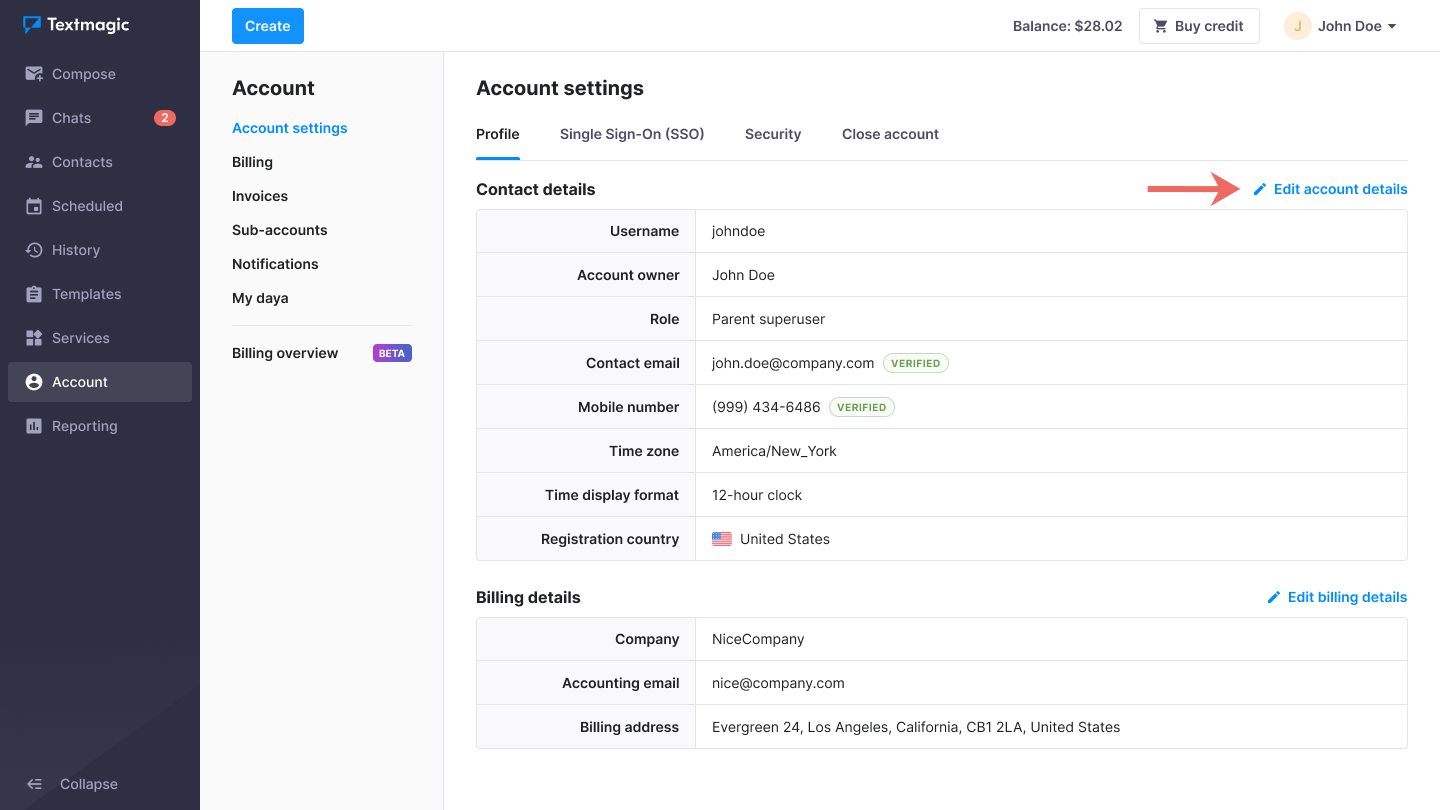

Review your Textmagic account details

It’s a good idea to ensure your account details are always up to date, because this information is displayed on your Textmagic invoices.

Update your Textmagic account details

- Navigate to Admin -> My account.

- Click Edit account details.

- Make the necessary changes.

- Click Save.

Manage your billing details

- Navigate to Admin -> Billing overview.

- Click Manage in Stripe next to Billing address.

- Make changes and click Save.

Will I be charged VAT or other taxes?

UK customers

All customers from the UK will be charged VAT 20%.

EU customers

To avoid paying VAT, you need to enter your organization’s registered VAT number into the Stripe portal while making the payment. Once you do this, you will no longer be charged VAT.

US customers

Textmagic applies sales tax to purchases in accordance with state nexus thresholds. The applicable tax rate varies based on your geographical region and is added to the purchase price.

If you are eligible for a tax exemption, please send your exemption certificate to [email protected] before making the payment.